Business Credit Card Stacking

Karnchea Barchue • January 5, 2025

Business Credit Card Stacking

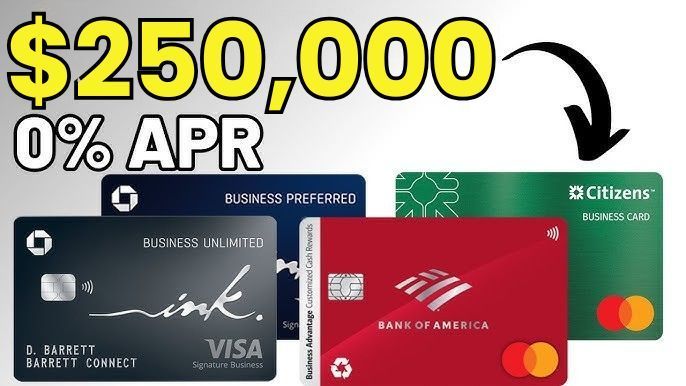

Business Credit Card Stacking is a financing strategy where a business owner applies for and secures multiple business credit cards within a short timeframe to access a significant amount of credit. This method is often used to fund startups, cover operational expenses, or consolidate debt.

Key Benefits:

- No Collateral Required: Unlike traditional loans, credit cards don't require business assets as security.

- Flexible Spending: Offers the freedom to use the credit as needed without restrictions.

- 0% Intro APR Offers: Many business credit cards provide interest-free introductory periods, allowing businesses to borrow without incurring immediate interest charges.

- Boosts Credit Profile: Proper management can help build a strong business credit score over time.

Risks:

- High-Interest Rates: After the introductory period, interest rates can be high if balances aren't paid off.

- Credit Score Impact: Multiple credit inquiries in a short period can lower your credit score temporarily.

- Debt Management Challenges: Mismanagement of stacked cards can lead to unmanageable debt levels.

Ideal for:

- Start-Ups

- Consolidation

- Entrepreneurs looking for quick and flexible funding.

- Businesses needing a temporary cash flow boost.

- Companies with a solid repayment plan to manage multiple credit lines responsibly.

Would you like more detailed information or assistance in implementing a business credit card stacking strategy?

You might also like

Commercial Lending News

*** All files are subject to full underwriting & qualifications specified by each bank. There can be no assurance that any applicant will be approved and that credit will be offered.***